Introduction

Hey there! Thinking about becoming your own boss and ditching the 9-to-5?

The internet has opened a treasure trove of opportunities for entrepreneurs, and with the right idea and some hustle, you can be well on your way to building a thriving online business.

In this post, we’ll be diving into 50+ of the most profitable online business ventures you can launch in 2024.

Whether you’re a seasoned entrepreneur or a complete newbie, there’s bound to be an idea here that sparks your creativity and gets your entrepreneurial juices flowing.

So, grab your favorite beverage, settle in, and get ready to explore the exciting world of online business!

Join Us!

Ready to take action and start earning online? Join my free email list for exclusive tips, strategies, and resources to help you make money online.

Sign up now! — https://bit.ly/3wR9rea

What is an Online Business?

An online business is a type of business that primarily operates through the Internet. This means that the business conducts most, if not all, of its transactions, sales, and communications with customers online.

The Internet provides online businesses with a wide range of opportunities, including the ability to reach a global audience, reduce overhead costs, and operate 24/7.

Online businesses can take many different forms, such as e-commerce stores, digital marketing agencies, online courses, freelance services, and much more.

In essence, any business that leverages the Internet to connect with customers and conduct its operations can be considered an online business.

Starting an online business can be an attractive option for entrepreneurs because it often requires fewer resources than traditional brick-and-mortar businesses.

However, online businesses also face unique challenges, such as managing online security and maintaining customer trust in the absence of physical storefronts.

Join Us!

Ready to take action and start earning online? Join my free email list for exclusive tips, strategies, and resources to help you make money online.

Sign up now! — https://bit.ly/3wR9rea

Why Should I Start an Online Business?

Starting a business is a major decision, and there are many factors to consider before leaping. With the rise of the internet and e-commerce, one option that more and more entrepreneurs are considering is starting an online business.

In this article, we’ll explore some of the top reasons why starting an online business may be the right choice for you.

1. Flexibility and Freedom.

One of the most significant advantages of starting an online business is the flexibility and freedom it provides.

With an online business, you can work from anywhere with an internet connection, whether that’s from your home office, a co-working space, or a beach in Bali.

You can set your hours and create a schedule that works best for you, allowing you to prioritize other important areas of your life, such as family, travel, or hobbies.

2. Lower Startup Costs.

Starting a traditional brick-and-mortar business can be expensive, with the need to rent or purchase physical storefronts, buy inventory, and hire employees.

By contrast, starting an online business typically requires lower startup costs, as you don’t need to invest in physical real estate or inventory. You can start small and scale up gradually as your business grows.

3. Access to a Global Market.

The internet has connected the world like never before, and an online business allows you to reach a global audience.

With an online presence, you can sell products or services to customers anywhere in the world, expanding your potential customer base and revenue streams.

4. Reduced Overhead Costs.

Operating an online business can significantly reduce overhead costs compared to a traditional brick-and-mortar business.

You don’t need to pay rent for a physical storefront or utility bills for a physical space, and you can operate with a smaller team, reducing your payroll expenses.

5. Opportunities for Innovation.

The digital world is constantly evolving, presenting endless opportunities for innovation and creativity.

Starting an online business allows you to leverage cutting-edge technology and marketing strategies to differentiate yourself from competitors and stand out in the crowded online marketplace.

6. Increased Revenue Potential.

Online businesses have the potential to generate significant revenue streams due to the scalability of the internet.

With the ability to reach a global audience and operate 24/7, online businesses can scale quickly and generate higher revenues than traditional businesses with physical limitations.

7. Ability to Measure and Analyze Performance.

One of the key advantages of starting an online business is the ability to measure and analyze performance.

Online businesses have access to a wealth of data and analytics tools that can help you track your website traffic, conversion rates, customer behaviour, and other important metrics.

This information can help you make data-driven decisions to optimize your business and improve your bottom line.

8. Easier Customer Acquisition.

Acquiring new customers can be a challenging and expensive process for any business. However, online businesses have access to a wide range of digital marketing channels that can make customer acquisition easier and more cost-effective.

From social media advertising to search engine optimization, online businesses can leverage a variety of strategies to reach and engage with potential customers.

9. Opportunity to Build a Personal Brand.

Starting an online business provides an opportunity to build a personal brand and establish yourself as an expert in your field.

By creating high-quality content and engaging with your audience on social media and other platforms, you can develop a loyal following and become a trusted authority in your industry.

10. Greater Control Over Your Destiny.

Finally, starting an online business gives you greater control over your professional and financial destiny.

You can set your own goals, choose your strategies, and build a business that aligns with your values and interests.

This level of autonomy and control can be a powerful motivator for entrepreneurs who are looking to create a fulfilling and meaningful career.

11. You have all the time in the world.

One fabulous thing about owning an online business is that you have all the time to yourself; you choose when to work and when not to work.

Depending on the type of online business you choose to set up, you can have much more flexibility in creating a work schedule that works for you.

You can choose what time of the day you want to work, how many hours you want to work and what days of the week you want to work as long as you set your business up efficiently.

12. You Can Choose Any Location Of Your Choice.

You aren’t tied down to a desk or a single location in an online business. As long as you have an internet connection and a laptop, you can run your business from anywhere.

You have the freedom to travel and choose where you want to work on any given day, and that’s hugely liberating.

The additional time that you gain from not having to commute and the freedom you get from working where you choose means you can be much more productive and have more freedom to set up a much more efficient and flexible schedule.

13. Higher Profit Margin.

In an online business, your income isn’t simply determined by the number of hours you work. Still, by the level of productivity, you can produce during the hours you work and the systems you have in place to generate a passive income.

You don’t have to be present for a transaction to occur; you have to be consistent with your efforts and focus on the right things to grow and sustain your business.

Using a blog as an example takes time and effort to build a sustainable blog, business, and brand. However, it is achievable, and the low barrier to entry means that most people can start immediately and begin their journey into creating a money-making business that they can be proud of.

14. Online Businesses Runs all the time.

As long there is internet access all over the world, then your business can never shut down. Unlike most traditional brick-and-mortar stores, an online business can be run 24 hours a day, seven days a week, even when you’re not in front of the computer.

And because websites are always online, it allows others to find what they are looking for quickly and easily.

This provides business owners with much more flexibility regarding both when and how they work by allowing the information, products and services to always reach those in need.

As long as an individual has a computer, tablet and smartphone, they can visit your online business or blog and get the information they need when they need it.

Join Us!

Ready to take action and start earning online? Join my free email list for exclusive tips, strategies, and resources to help you make money online.

Sign up now! — https://bit.ly/3wR9rea

What are the most Profitable Online Businesses To Start?

Making money online does not require a great deal, all you just need is to get started from somewhere.

There are so many ways to make money online that, you can’t cover once, so you have to take it one after the other. Here are some of the very few money-making online businesses that I recommend you try out.

1. Start a Blog.

One of the biggest online business ideas to start is blogging. you can start a blog with less than $50. Blogging will last for a much longer time, as long as people continue to explore knowledge via the internet.

And with more people anticipated to get access to the internet, one can only foretell a radiant future for bloggers on the internet.

Unlike other businesses which will demand you to invest thousands of dollars, Blogging is one of the cheapest business models that can be invested in.

You can begin a self-hosted WordPress blog by just purchasing Domain Name and Web Hosting which will cost you as low as $3/Mo.

There is a lot to be said about blogging, which is why I recommend you read this article to help you get started.

2. Start a YouTube Channel.

YouTube is the third-most-visited site next to Facebook and Google search. Videos have the potential to reach a larger audience than any other platform online.

All you need to do to get started on YouTube is to Choose a particular niche like Tech, gadgets review, like that.

Research some potential keywords in your YouTube niche. The keywords should have good traffic. Just Google the keyword, and make sure that the top 10 results won’t contain a single video result.

By this, you can determine the best keyword to create a video on. Here keyword research is crucial when trying to gain traffic on YouTube.

You simply make money on YouTube when someone from any part of the world watches or streams your video. Imagine having a huge audience, now you know that is real money.

I wrote an article on how you can get started with making money on YouTube.

3. Become an Online Freelancer.

A freelancer is someone who offers their services for a fee and usually with no expectation of a permanent single client, although the working relationship can be ongoing.

It’s a form of self-employment, similar to operating a home business versus telecommuting. With that said, a freelancer can work as a contractor, as opposed to a home business.

The internet has made the process of working decentralized, you can be anywhere in the world and get a job in another part of the world once you have an agreement and a memorandum of understanding, some platforms fulfil this purpose and one very popular is called Fiverr.

4. Become a Social Media Influencer.

A Social Media Influencer is a user on social media who has established credibility in a specific industry.

A social media influencer has access to a large audience and can persuade others through their authenticity and reach.

As a social media influencer, you have tons of followers and a very huge audience waiting to engage you with every single post.

You can turn that huge attraction into big money, here is an article I recommend you read to get started as a social media influencer.

5. Become a Video Editor.

Video editing is one of the hot industry skills right now, everything seems to be going virtual now, right from advertising, to filming and so many others, all these rely on the implementation of video editing skills.

Getting started with video editing is very easy, all you need is a personal computer and video editing software. If you are addicted to and good at editing, there is a lot of cash to be made in video editing.

The initial thing to do is to find your niche. Do you want to edit corporate videos, produce wedding videos or create advertising campaigns?

Next, you need to develop a relevant portfolio. Most new video editors begin by volunteering their services for free to their ideal client, or first few clients, with time, you will begin to improve.

Here is an article I recommend you read to get started with video editing.

6. Graphics Design.

Another industry hot skill set is graphics design, every industry seems to be evolving around graphics design, right from social media, advertising and so many others. You can get deals online from freelancing websites such as Fiverr and Upwork.

7. Develop Mobile Apps.

The recent shift in the tech world has made it mandatory for people to start consuming mobile apps more than ever before, every known software and start-up has mobile applications distributed all over the place.

Apart from the fact that mobile apps are on the trend, you can start developing mobile apps and make very good money.

Here is an article, I recommend you read to help you get started with mobile app development.

8. Become a Web Developer.

Having a website has become a prerequisite for almost all strong businesses, but most people still require the skills they need to produce one themselves.

As a web developer, you are granting an indispensable service to most companies, and you will never be deficient in clients.

Web development is becoming very popular, and very much in high demand, all you need to know is just very few web terminologies and even learn to code.

Don’t be scared, web development is not a very difficult field, it is very easy to learn, and you will find it very easy as soon as you start.

Here is an article I recommend you read to get started with web development.

9. Start a Digital Marketing Consult.

So many newbie businesses don’t know how to take their business online, they constantly try to do it for themselves, but in the very long run, they make mistakes.

As a digital marketing expert, all you need to do is make sure your businesses are getting enough visibility online.

This can be done with the understanding of how search engine optimization, paid and unpaid social media advertising and directory listings tools like Google My Business.

Here are very few articles that I would like you to go and read carefully so that you can understand what taking a business online seems like.

10. Buy and Trade cryptocurrencies.

A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend.

Many cryptocurrencies are decentralized networks based on blockchain technology, a distributed ledger enforced by a disparate network of computers.

A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

Cryptocurrencies are just like Gold and real estate, they are very likely to appreciate and most times you can lose largely on them.

I wrote an article on how you can get started with Cryptocurrencies, I recommend you read it by clicking the link below.

11. Catering Business.

Most people have become very busy that they do not have enough time to cook healthy meals, spending most of their diet on junky meals This has led to a rise in the catering business offering all kinds of cuisine options.

You can capitalize on this trend by starting a catering business right in your city, state, or neighbourhood.

You don’t need to own a large portfolio to get started as a caterer, most orders would be placed when needed, and in the long run, you don’t always have to cook every time, advertising can be made online to target clients who are nearby.

I wrote a comprehensive guide to help you get started as a caterer, click the link below to get started.

12. Start a Podcast.

A podcast is an episodic series of spoken word digital audio files that a user can download to a personal device for easy listening.

Streaming applications and podcasting services provide a convenient, integrated way to manage a personal consumption queue across many podcast sources and playback devices.

Podcasts are hugely uncertain, suggesting entertainment, information or a combination of both. Podcast providers offer digital, audio-based files.

Listeners have a higher path to podcasts than ever before, via Spotify, Apple Podcasts, BuzzSprout, Podbean, Simplecast and Captivate, to name a few

A podcast is one way to get your voice to the world, If you have unique speaking talent, then you can start a podcast.

I wrote an article on how you can start a podcast and make very good money and I suggest you read it very carefully.

You can also check out this article and why I recommend using Podbean for your Podcast hosting.

13. Start a Dropshipping Business

Are you contemplating selling products online but don’t have the money to buy and store inventory? Consider starting a Dropshipping business.

Dropshipping is an eCommerce business model in which you don’t have to handle any physical products.

All you have to do is set up an online store and associate with third-party suppliers who are always available to store, package, and ship orders to your customers.

I wrote a comprehensive guide to help you get started with Dropshipping, click the link to get started now.

14. Become a Freelancer.

Freelancing is another cool job to get started with when seeking to start any business online. As a freelancer you work for people from various parts of the world, I know you would be questioned as to how this can happen but I will explain.

The ability and the liberty to work for anyone from various parts of the world has been made only possible by the help of a freelancing website and platform, and one that I know too well and will recommend any day and time is Fiverr.

You can make over $3000 on Fiverr as a starter, it all depends on how well you understand the platform and how highly skilled you are. Here is an article I recommend you read to help you get started on Fiverr.

15. Software Education.

Do you have colleagues who lack knowledge of computer software or tech-related stuff? If so, you can start your own software education business and register students for training monthly.

Trust me, so many people make money from this business, these skills are not taught in schools regularly, and are in very high demand.

Possible students might include entrepreneurs looking to build on their IT skills, or other small business owners looking to master software like Excel and PowerPoint. If you know, you can lead from the front by teaching most of the classes.

As your business expands and more people sign up for your programs, you can seek the services of freelance software experts to teach students based on their area of expertise.

You should consider hosting virtual classes to keep costs low and increase your business to global markets.

16. Sell Digital Products

Selling Digital products has also become a great business opportunity because they are not expensive to create and share. You can make it once and sell it frequently to several people without having to stock your inventory

E-learning is blasting as an industry. Modern studies show that the industry will be worth around $331 billion by 2025, making digital products one of the best online business opportunities for creators and educators alike. Music, videos, eBooks, and online courses are a few examples.

If you consider yourself an expert on a particular topic, you can package that knowledge up and sell it in the form of a one-time fee or subscription.

I wrote an article to help you get started with selling eBooks and making cool money with them.

17. Become a Copywriter.

Copywriters produce marketing content to sell a major product or service. Have you ever found yourself on a website and been compelled to buy something with a display of testimonials, videos and a call to action button? That is copywriting.

Copywriters are always in need, and big brands will pay notable amounts of money for efficient advertising campaigns. A powerful, engaging and grammatically sound copy can earn you huge amounts of money.

18. Create a grow Private Facebook Group.

There are many ways that a dummy can make money on social media with just a smartphone, and one of those lucrative businesses to start is the use of a Facebook group.

If you have a vital online presence on the internet, you can almost certainly begin to make money with it.

If you are the admin of a famous Facebook group (about 5,000 members or more), you can immediately turn your page into a profitable business.

Currently, brands have no way of posting in private Facebook groups without expressly hitting a deal with the administrator of such groups, which is how you make money.

19. Start an Online Dating Business.

Online dating has flourished in the last ten years. Websites like Match, and Tinder have taken the top spots when it comes to online dating.

In February 2019, a predicted 50 million people worldwide were using Tinder. No wonder it has become a moneymaking industry, drawing worldwide revenue of over £1.4 billion every year.

That said, having a background in psychology or some counselling training gives you more credibility. It’s also a business you can run entirely online.

You can choose to offer phone consultations, e-mail consultations or even sessions on an instant chat.

Social media has even made it interesting to start as an online dating consultant. To sell your services, create a website and attempt advertising on social media.

20. Become an SEO Expert.

Do you have expertise in producing backlinks and improving the search engine visibility of any kind of website? If yes, then there is a chance for you to make money today.

The majority of businesses spend a lot of money developing a website and do not make use of it because they don’t understand SEO.

SEO is a type of internet organic marketing that keeps the traffic coming back without any hassle.

SEO is not hard to get started with, you don’t even need to learn how to code to do SEO, all that is needed is a basic understanding of how the internet works, and that settles it.

Site owners worldwide demand the services of SEO experts, so opening a business in this area could turn out to be one of your best choices.

Just in case you seek a place to get started, I wrote a comprehensive guide to help you get started with search engine optimization.

21. Start a SaaS business.

SaaS stands for software as a service. It’s a business model where customers buy software solutions online on a subscription basis. An online SaaS business is an excellent choice for those who know how to write codes

When starting a SaaS business you need to offer a free trial initially, to allow prospective customers to see how your software works for some time and let them pay as soon as the trial is over.

22. Produce and sell your music.

There are so many music artists in the world now, and one major problem they have is that they cannot sell their music, and make money with it.

Musicians can profit from their talent by selling their art online. There are lots of different ways to make money through your music online.

You can create those tracks and begin to distribute them to online music stores like iTunes, Spotify and many others, and start earning royalties when someone’s buy your track.

If you are a music artist reading this article, I count you very lucky because I wrote a comprehensive guide to help you start making money from your music business.

23. Multi-level Marketing.

Multi-level marketing programs are essentially sales programs designed for salespeople. I usually advise people to be very good at sales before starting a network marketing business. it becomes easy to recruit people and duplicate your effort on each of them.

I love network marketing because it is a business that does not allow you to recycle the process from scratch, all you need to do is to sell, and you don’t have to worry about the product because they are always ready.

That said, always be conscious of pyramid schemes disguised as multi-level marketing programs. I wrote a comprehensive guide to help you get started with network marketing.

24. Produce and sell a diet plan.

Selling a diet plan is one of the most effortless ways to earn money in the health and fitness industry.

Before selling any product with a claim to boost health, you need to be sure that you have interviewed appropriate professionals and have done enough research.

Also, you should be aware of the competition in the market and you have to be creative about your approach.

There are so many ways to start selling out your business, most of which include, the use of social media, email marketing and many others.

25. Become an Online Translator

Have you learnt a foreign language and you seek out various ways to make money from it? then stay glued to this section because you can start making money from your passion.

Tourism, recruitment and journalism are a few of the many industries that have a high need for translation services.

As a translator, clients will hire you to translate a range of materials and texts, such as marketing materials for businesses, the novel of an author looking to sell their work in another country or the personal documents of an individual, including foreign job applications and passports.

Translators typically charge a fee per word, though you can also set prices per project, per page or hour.

26. Buy and Sell Websites.

The art of buying and selling websites is just like the same concept used in real estate, all you need to do is buy undervalued websites, improve them marginally and sell them for a profit.

Not only can you make money on the sale itself, but you can also earn a steady profit on top of that, making it one of the most profitable online business opportunities, if you get it right.

You can find websites to purchase either directly from buyers, or from website brokers and marketplaces, such as Wesellyoursite.com, Flippa.com and WebsiteBroker.com, to name a few.

A website that generates a lot of traffic is usually the most expensive when it comes to making a profit as a seller.

Once your website starts getting lots of traffic from at least 50K monthly, then that website is suitable for sale.

27. Create and sell an online course

If you are a professional in a selective area, you can create an online course to take members through coaching or education on a topic.

Besides your expertise in such a subject matter, you will need to be proficient at designing media that can deliver the training, in the form of videos, podcasts, websites or apps.

One main advantage of this business model is that once you have produced your programme, all you need do is sit down, relax, and watch your income grow. Your courses will make passive income as they exist on such a course hosting platform.

As an online course provider, you may contemplate using platforms such as Udemy, Skillshare and Teachable to grow your sales and market your product.

To help you quench your thirst for this topic, I wrote an article to help you get started with creating online courses and making money, click the link below to get started.

28. Start Writing CVs

CV writing is an easy career to get off the ground and can be profitable. All you need to get going is a Laptop the internet and some clients to get started, you need quality Marketing, too.

You can also advertise your services on websites such as LinkedIn, Xing and Fiverr. As a CV writer, your next action is to choose a suitable format and choose a glossary that will appeal to potential employers, without making the applicant sound arrogant and “too good to be true”.

A great resume or cover letter needs to highlight an individual’s skills, be relevant to the post applied for, and have a positive tone.

You can also watch videos on YouTube to learn from experts from all over the world to help you amplify your skills.

29. Become an Email Marketing Specialist

The purpose of an email marketing specialist is to operate with businesses to increase their email communication and step up their marketing campaigns.

In this job, specialists help clients to evaluate and develop their email communication as a marketing method. They may also be involved in creating and setting up email campaigns.

The startup costs are low with marketing your services being your only expense. The more knowledge you have in marketing and advertising, the more you can charge.

Just in case you have no idea of how email marketing works, I wrote a comprehensive guide to help you get started.

30. Start an Alibaba Business.

If you understand how Dropshipping, or an eCommerce business works, then starting an Alibaba business will not be hard to understand.

The principle behind every eCommerce or Dropshipping business is to buy at a cheaper price and sell for profit.

Alibaba is an eCommerce platform that showcases products from manufacturers based and produced in China.

Most of the products you see on online stores like Amazon, eBay and all other top eCommerce giants are bought in China from manufacturers at very affordable prices and are sold thrice at the initial price.

I wrote a comprehensive guide on starting an Alibaba business on this blog, click the link below to read it now.

31. Become an Online Personal trainer.

A personal trainer is someone who helps people attain a certain level of health and a fit lifestyle.

Fundamentally, a personal trainer is supposed to be onsite with a client, but the internet has made it very easy to make more profit by establishing your business online, to train more people.

Coaching is done entirely online through courses, one-to-one video calls or pre-built programs. The benefit of becoming an online personal trainer is that you can take on far more clients and observe progress far more efficiently.

Many personal trainers use platforms such as Truecoach to monetise their training content because of the high possible client traffic. However, platforms like this do charge a subscription fee.

Just in case you don’t have an idea of what it takes to become a personal trainer, I wrote a comprehensive guide on this blog to help you get started without hassle.

32. Offer HR consultancy online.

An HR(Human Resource) is someone who helps companies recruit talent. If you are following up with the trend, recruiting has shifted to the internet with thousands of job softwares now being created. Most companies prefer to hire the services of a third-party HR that has been trained to help recruit personnel.

Duties include the implementation of talent management programmes, describing the legal aspects of employment, structuring promotion and giving advice on how to create a diverse and inclusive working environment.

If you have experience in HR, there is no reason why you can’t work for yourself and take your business digital.

Experience in the industry often comes with a useful network, which creates a sound foundation for seeking clients.

Make sure you have a solid online presence and develop a marketing plan to advertise your services. I wrote a comprehensive guide to help you get started with marketing your services as an HR, click the link to the article to read it.

33. Start Trading on the stock market.

Stock markets are where individual and institutional investors come together to buy and sell shares in a public venue.

Let’s say you want to own part of a company like Tesla, Boeing, or Cocacola as an investor, the stock market is designed to allow you to own part of these companies without any hassle.

Stock traders buy and sell stocks frequently in time with shifting markets. The aim is to purchase shares at a low price, hold them for short periods, and then capitalise on market changes to sell them for a considerable profit.

As a stock trader, all you need is a smartphone or a Laptop and an online stockbroker such as Etoro, Plus500 and IG to purchase stocks. It works just like cryptocurrencies, but this time you are betting on the success of your favourite company.

Trading stocks online will lower your buying costs compared to trading through a brokerage firm.

You should also know that it’s a highly risky business venture which requires ample research and knowledge.

Before you start, it is necessary to study the market and research current trends. A good way to keep up to date with market trends is to subscribe to business and trading magazines.

34. Develop a Chrome Extension.

Google Chrome has come all the way to become one of the world’s best browsers, and this has made it come with extra tools to extend its capability.

Tech-savvy individuals can monetise their skills by producing a Chrome extension. Chrome extensions customise a user’s browser and serve as add-ons allowing users to tailor their browsers to perform specific functions.

Chrome extensions are designed to enhance the user experience by extending Chrome’s capabilities.

All you need to create a Chrome extension is proper knowledge of HTML, CSS and JS. Once you have designed an extension, you can sell it on the Google Chrome store. Chrome is such a reliable interface that it gets meaningful site traffic, meaning high exposure.

I wrote a comprehensive guide to help you get started as a web developer, click the link to get started.

35. Design and sell on TeeSpring.

TeeSpring is a fabulous website for creatives who want to reduce the business side of things such as owning a factory and many others.

TeeSpring allows you to create and sell apparel and takes care of production and shipping.

Most times we want to start our clothing merchandise but don’t know how to, Teespring is an amazing platform to help you get started.

Teespring is completely free to use.TeeSpring sets the base price of an item which it’ll keep, you set the sale price and keep the profits.

Don’t charge too high setting a modest price initially will make the most interest. If a campaign does well, consider relaunching it at a higher price.

36. Become a Business Plan Writer.

Business plan writing is one of the most lucrative businesses to start and make money, so many people need a business plan document to get business grants or any kind of funding. All successful businesses need a solid business plan.

To become a business plan writer, you should ideally have some experience in the business. You need to understand all aspects of a business plan to be able to produce one for somebody else.

You’ll also need impeccable grammar skills and a professional writing style. To find customers, you can advertise on entrepreneur websites or contact businesses directly.

Writing business plans can be extremely profitable. Big companies will pay thousands for a thorough plan, so make sure you’ve got expertise on all the necessary components of a business plan.

37. Become a cryptocurrency miner.

When you ask anyone familiar with how online business works, one of their major preferences is attributed to cryptocurrencies.

The demand for cryptocurrency has risen in recent years. Many cryptocurrencies are revealed through a mining process, which introduces new coins to the market.

Cryptocurrency miners ensure that transactions between users are authentic and are then responsible for adding each sale to the blockchain.

The better-known currencies, such as Bitcoin, are also the most competitive, and you may not be able to compete with enterprises in the industry mining in such popular currencies.

I wrote a comprehensive guide to help you get started with cryptocurrencies, click the link to get started.

38. Provide a Legal Writing Service

Legal writing is a type of technical writing used by lawyers, legislators, judges and other legal professionals to form legal analysis, legal rights and responsibilities.

This type of text requires citations from a legal authority, and must often follow a designated format and include technical terms.

The most common types of legal documents are hiring contracts, company bylaws, meeting minutes, operating agreements, non-disclosure agreements, terms of use, contractor forms, leases, claims and complaints.

Experience in law is necessary, and clients will want proof of this in the way of a degree or previous work experience in a law firm.

It’s an accessible business to start and has minimal startup costs. Legal writing does, however, require a particular skill set.

39. Become an Online Business Consultant.

As a business consultant, you will be assisting clients with expert advice in areas such as management, accountancy, law, HR, marketing and every area involved in starting a business.

Your main tasks will be to strategise, plan and problem-solve together with your clients to help improve their business.

Working as a business consultant requires a specialist skillset. A basic experience in such an industry as well as an extensive business background. The more experience you have to offer, the more you can charge for your services.

40. Become a Freelance Illustrator.

Illustrators can sell their designs online in a multitude of profitable formats. If you are creative, you can easily capitalise on your skills as an illustrator and make money.

There are so many companies and advertising agencies that need illustrators to help spice up their brands.

All you need to get started as an illustrator is the need to make use of tools such as Adobe Illustrator and many others.

To find clients, you will need to sell yourself: start with a website featuring examples of your designs and reach out to as many businesses and magazines as you can, also you can leverage the power of social media platforms like Facebook, Twitter and many more.

41. Statistical & data analysis.

Almost every professional field needs this kind of research. Common types of data analysis include regression, time series, panel data, experimental designs, factor analysis, principal component analysis and Bayesian analysis, to name just a few.

To find work as an analytical researcher, you can advertise on the freelancer websites like Fiverr, or simply set up your site to promote your services.

Examples of the tools used to perform statistical analysis are Excel, Stata, MINITAB and Eviews. To be successful in this field, you’ll need a mathematical or statistical background, and ideally some knowledge of your target industry.

If you have a skillset, data analysis can be a productive career. Businesses need data analysed for all sorts of purposes, meaning you will always be in high demand.

42. Start an Amazon FBA Business

Amazon FBA stands for “Fulfilled by Amazon”. The Amazon FBA program was created to help retailers own and host their businesses alongside Amazon.

In this industry, you need to buy cheap products from wholesale sellers and list those items at a much higher price on Amazon and send traffic to it, once an item of yours is purchased via Amazon, it is delivered on your behalf, and you get a profit at the end of the month.

You need to sell white-labelled products and ship them to Amazon fulfilment centres in the US. Those FBA centres handle the shipping, packaging, and support for the products at no extra cost.

You need to find a niche in Amazon FBA too. For that, you can make use of great tools like the JungleScout Product research tool.

I wrote a comprehensive guide on how to start an Amazon FBA Business. Check out the link to the article below to learn more.

43. Become an Airbnb Host.

Airbnb connects people with places to stay and things to do around the globe. The community is powered by hosts, who provide their guests with the unique opportunity to live like a local while travelling.

You may have thought about offering up an extra room in your house or putting your entire apartment up for a share on Airbnb.

Airbnb is one prolific way to make money online if you reside in a country where tourism is on the rise.

Then you can register with Airbnb, and start meeting with people who would pay you to occupy your home temporarily.

I wrote a comprehensive guide on how to start an Airbnb Business. Check out the link to the article below to learn more.

- How To Become an Airbnb Host In Nigeria

- How To Start an Airbnb Business In The UK

- How To Start an Airbnb Business in The US

- How To Start an Airbnb Business in Canada

44. Start Your Social Networking Site

When you look at big techs like Facebook, Twitter and Instagram you wonder why they outshine so many other tech giants.

The reason behind their massive success lies in the number of their community. All they do is simple, they bring people together.

The fact that there are several big-time networking websites does not in any way stop you from starting your social networking site.

For example, you can start a social networking site that connects people of the same ethnic groups or people with similar interests and so on.

I wrote a comprehensive guide on how you can start a social networking website and make money, check out the article to learn more.

45. Develop an Online Book Store.

Information products remains relevant, and people will continue to keep looking for information for eternity.

Another online business idea you can start is to create an online bookstore. You can start by trading your old and unused books with your family members and friends.

There are book lovers all over the world who are still engrossed in buying books no matter the amount it will cost them.

Starting an online bookstore is another way of making money from the internet. A company like amazon.com are making enormous revenues from selling books online and you can start something similar.

I wrote a comprehensive guide on how you can start selling e-books and creating your online store.

46. Become a WordPress Website Consultant.

WordPress is the most popular website builder in the world, powering over 90% of all websites on the internet, which makes it a hot cake when it comes to designing websites.

A WordPress developer is an expert who concentrates on the support and ecosystem of the WordPress platform. WordPress development is a profitable field that attracts companies as well as independent freelancers.

Do you know that average WordPress developers make between $45,000 and $150,000 per year from their development work?

I wrote a comprehensive guide to help you understand WordPress as a beginner. Click the link below to read it now.

47. Become an Online News Correspondent.

The majority of newsrooms all over the world are not usually at the incident when it happens, hence the need for a correspondent.

Online journalism refers to the broadcasting of national and international news via the Internet. Although it is similar to traditional journalism, diverse features differentiate one from the other.

This medium is also more interactive, and online publications are simpler to access than print or broadcast newspapers.

Online journalists need to have at least a bachelor’s degree in both journalism and mass communication.

You can start earning money online by working as a news contributor. You can apply to any of the online news platforms, and start contributing news to their platform, after which you will get paid per news contributed.

I wrote a comprehensive guide on how to make money online as a journalist. Check out the link to the article to learn more.

48. Remote Computer Repair Services.

The world has become a global village and there is little or no need for a physical location to do business. All you need to survive and do business in the world today is a skillset and a handful of clients.

This business model can be applied to any field of business today, but in this section, we are going to be discussing how it can be effectively applied to remote computer repair services.

If you know a thing or two about computer repairs or you are willing to learn, this is a service that you can easily earn money from doing without investing a dime.

Getting clients at first can be a bit challenging, you may need to put up ads on Facebook, and WhatsApp and even develop a website where your clients can call if they need you.

49. Offer Voiceover Services.

Talent has become one of the major keys needed to unlock wealth in this age. Do you have a good voice, or maybe you are a singer, seeking out opportunities?

There are thousands of voiceover jobs waiting for you. If you have no business startup capital, your good voice and fine diction are assets; with it, you can produce extra income for as long as you are willing to work.

When getting started in voice acting, you simply don’t know what you don’t know. You may have a natural talent for voice-over, but the constant need for education is effective and crucial to success.

There is so much value in attending training sessions and hiring a voice-over coach. At first, it may be hard to get jobs, at this point, you need to initially develop a client base, and even charge less, but as time goes on, you eventually get better at the job.

One place to get started is Fiverr. I wrote a comprehensive guide to help you get started on Fiverr as a voice-over artist. Click the link below to get started.

50. Start an Online Sports Betting Business.

Look at the world today, one universal language that is been spoken by every nation of the world is sports. Nigeria is one of the many African countries that is being overwhelmed with the scourge of online sports betting.

This includes online poker, casino games, and sports betting. The sports betting and gaming industry has grown astronomically in the last two years.

This outstanding growth can be credited to the large population of the nation and increased access to internet devices. An online sports betting business is a profitable business that you can start with as low as nothing in your bank account.

Distance is no longer a limitation when it comes to placing bets. So, if you love sports and you love betting, then you should consider commencing your own online sports betting business.

51. Start an Online Car Dealership Business.

It is the dream of everyone to someday own his/her car, so therefore starting your own car dealership business can bring your massive profit.

Trust is one element in this business to make it successful, note that not all clients will trust you easily, so you have to make your online presence known.

All you need to do is to create a website where the cars that you want to sell can be listed. You can deal in fairly used cars or brand new cars or both and still attract customers from all over the globe.

Also, with the aid of digital marketing platforms like Facebook, Twitter and many more, it has become easy to launch and start an online car dealership business.

Also, bear in mind that you need access to an inspection site for the clients to inspect and purchase the car.

52. Teach People How to Cook Online.

Most of the time, when people need to gather basic cooking knowledge, one of the first places that they visit is the internet. If you are good at making both local and international dishes, one of the online businesses you can engage in is to start teaching people how to cook.

This kind of business is easy to kickstart because all you need is a YouTube channel, blog or better still a huge social media following across all social platforms.

Better still you can subscribe to the service of an online tutoring website and charge for your course.

I wrote a comprehensive guide on how you can start your own catering business now and start making money with it. Click the link below to get started.

53. Start an Uber Business.

Like I will say, when I am about to talk about something related to the internet-of-things, Technology has done a lot in making the lives of people way easier than it was back in the day when the impact of technology was not felt in any way.

The Uber platform is supposed to have over 100 million users in different parts of the world with more people all over the world still signing up to make use of the platform.

Starting an Uber business is comparatively easy, once you fulfil the following requirements such as.

- Having a valid driver’s licence.

- Completed a safety screening.

- Be more than 21 years old.

- Also, Vehicles to be used for operations need to have an A/C, a Working radio and four doors.

Just before you hit the road, you will need to upload the documentation which includes uploading valid vehicle insurance and driver’s license. If the vehicle is your vehicle, you should also upload your vehicle inspection report to your profile.

Once you have finished your documentation process, the next step is to create your account. After uploading all your documents, your vehicle will be activated.

The Uber app is available for both Android and iPhone smartphones. When a rider needs a taxi service all he has to do is press the request button and the platform is programmed with a special algorithm to match the rider to a nearby driver with a pre-verified taxi.

However, if you have collected money during any of your trips, you are to submit all cash acquired to your corresponding Uber Partner. As an Uber business owner, you can acquire up to $500 a week or even more.

I wrote a comprehensive guide on how to Start an Uber business. Check out the link to the article to learn more.

54. Become a Product Designer(UI/UX).

Product design is one of the stress-free, non-technical and money-making careers in the tech industry. I love product design because it is one of the soft skills that make money the most.

Product design describes the process of imagining, creating, and iterating products that solve users’ problems or address specific needs in a given market.

Product design has many titles attached to it, in most cases, they are called UI Designer, UX Designer, Unicorn UI/UX Designer, UX Rockstar, and Information Architect, the titles are many, but the goal remains the same, designing a user journey that is so seamless, that it fades into the background and stops to be noticed at all.

You need no formal knowledge whatsoever to start as a product designer, all that is needed the most is determination and willingness to learn.

You can then complement your efforts by attending boot camps, and YouTube Videos and creating your portfolio which can end up landing you the best job of your dreams.

55. Become an Illustrator.

When it comes to starting a career in tech, you don’t need to become the geeky one who can write all the codes.

There are a lot of tech careers and businesses that do not require you to write a single line of code to make huge money from them, and one of those fields is becoming an illustrator.

It’s an exceptional time to start a career as an illustrator. Long gone are the days when print media was, well, the only media.

The internet has changed the way most people think of the term “illustrator.” Many companies hire illustrators to work on logos, marketing materials, and social media ads.

And there are dozens of other less traditional ways to use your illustration skills—as a forensic artist, fashion illustrator, stationery designer, or tattoo artist, to name a few!

You don’t need a university degree to kickstart a career as an illustrator, there also isn’t a straightforward path to reaching that goal, either.

Becoming an illustrator is quite easy, all you need is;

- Learn the basics.

- Draw What You Want.

- Don’t Compare, but always check out the work of other illustrators.

Finding a job or starting a business as an illustrator is easy, you can post your service on Fiverr, or better still build your portfolio and get a job in a tech company.

56. Become a Product Manager.

The tech world is becoming bigger by the day and is giving birth to more roles. One of these roles is called Product management.

The Product Manager is also a key player in the product development and management teams. They are in charge of sharing information and making sure everyone is clear on their objectives.

A product manager is responsible for planning a product vision and creating an actionable strategy for bringing it to production.

According to Glassdoor, a product manager makes an average of $111,090/year. On the low end, product managers can make $72,000/year, and on the high end, they can make $171,000/year.

Getting started as a product manager is not as difficult as it seems, all you need is to ensure that you have the following.

- Learn about the role and talk to current product managers.

- Get certified in product management.

- Start a side project and document it.

- Build a technical background.

- Apply for a Product Management role.

57. Sell Your Art Online.

Some so many people create amazing artwork a major problem lies in the inability to monetize them, most of these artists go as far as creating a website, social media platforms and many others, which they eventually get orders to sell from potential buyers.

This is one way to make money as a Visual artist, but there are still other creative methods that can be used to monetize your artwork efficiently, and this is called NFT (Non-Fungible Token).

An NFT is a collectable digital asset, which holds value as a form of cryptocurrency and as a form of art or culture. Much like art is seen as a value-holding investment, now so are NFTs.

NFT stands for a non-fungible token a digital token that’s a type of cryptocurrency, much like Bitcoin or Ethereum.

Creating and selling an NFT can make you much more money than you expect, your artwork can be bought globally and get to the eyes of many other people all over the world.

I wrote a comprehensive guide on how to get you started with NFTs, click the link below to get started.

58. Start collecting NFTs.

The advancement currently taking shape in the cryptocurrency scene has made it easy for anyone to start investing in it, one of which I am going to explain is the advent of (Non-fungible tokens) NFTs.

NFT Art Collectors are fans of both crypto and art and have become the reasons why top NFT artists are hitting jackpots these days.

NFT Art Collectors, are known to evolve their collections from time to time. With tokens going from one hand to the other, NFT Art Collectors, NFT artists, NFT marketplaces and sometimes the whole sphere have witnessed a metamorphosis.

The goal is to purchase the art for a specific period and resell it for profit, it’s like real estate. To buy, sell, or create NFTs, you need a digital wallet that supports ERC-721 (the Ethereum-based NFT token standard).

I wrote a comprehensive guide on how to get you started with NFTs, click the link below to get started.

59. Freelance Writing.

Harness the power of words and craft compelling content for websites, blogs, and businesses.

From articles and blog posts to website copy and product descriptions, the freelance writing world offers a vast playground for your creative voice.

Sharpen your skills, build a portfolio, and connect with clients on platforms like Upwork, Fiverr, and ProBlogger.

60. Become an SEO Consultant.

Become the wizard behind the curtain, guiding websites to the top of search engine results pages (SERPs).

Master the art of keyword research, on-page optimization, and link building, and help businesses attract organic traffic and boost their online presence.

Offer consulting services, develop SEO strategies, and watch your clients climb the search engine ladder.

61. Become a Podcast Host.

Unleash your inner storyteller and captivate audiences with your podcast. Choose a niche you’re passionate about, interview interesting guests, and share your unique perspective with the world.

Monetize your podcast through sponsorships, advertising, or premium content, and build a thriving online community around your voice.

62. Sell Stock Photos & Videos.

Turn your eye for beauty into a profitable venture. Capture stunning images and captivating videos, and license them to websites, blogs, and businesses.

Platforms like Shutterstock, iStock, and Getty Images provide a global marketplace for your visual artistry.

63. Develop Webinars & Workshops.

Share your expertise and knowledge through engaging online workshops and webinars. Choose a topic you’re well-versed in, create informative content, and connect with participants through live sessions and interactive Q&A.

Charge registration fees, offer exclusive bonuses, and build a loyal following eager to learn from you.

64. Sell Digital Products on Etsy.

Etsy isn’t just for crafts anymore! This vibrant platform offers a thriving marketplace for digital products like pintables, templates, eBooks, and online courses.

Design valuable resources, package them attractively, and reach a global audience of eager buyers.

I wrote a comprehensive guide on how to sell digital products on Etsy, check out the link to the article below to learn more.

65. Offer Personalized Products.

Add a touch of individuality to everyday items like mugs, t-shirts, and phone cases. Create custom designs, offer personalization options, and cater to individual tastes.

Utilize platforms like Redbubble or Printify to print and fulfil orders, and watch your personalized product business blossom.

66. Launch a Print-on-Demand Business.

Let your creativity take centre stage without worrying about inventory or shipping. Partner with print-on-demand services to offer custom-designed apparel, accessories, and home décor.

Design eye-catching graphics, market your brand effectively, and watch your print-on-demand empire flourish.

67. Offer Data Analysis & Consulting.

Help businesses unlock the power of their data. Master the art of data analysis, visualization, and interpretation, and provide valuable insights to drive informed decision-making. Offer consulting services, build custom reports, and become the data guru businesses crave.

I wrote a comprehensive guide on how to become a data analytic consultant, check out the link to the article to learn more.

68. Become a Cyber Security Specialist.

Protect businesses from the ever-evolving threats of the digital world. Hone your skills in cybersecurity, network security, and ethical hacking, and offer your expertise to businesses eager to safeguard their online assets. The demand for skilled cybersecurity professionals is sky.

69. Start a Gaming Channel or Blog.

Entertain and engage the booming gaming community through your own YouTube channel or blog. Share gameplay footage, offer insightful reviews, or build a niche around competitive esports.

Monetize your passion through ad revenue, sponsorships, merchandise, and even streaming platforms like Twitch.

I wrote a comprehensive article on how to start a gaming channel, check out the link to the article below to learn more.

- How To Start a Blog and Make Money

- How To Start a Gaming YouTube Channel

- How To Start a Gaming Blog and Make Money

- How To Build a Gaming PC For Beginners

70. Develop AR/VR Experiences.

Shape the future of entertainment and education by creating immersive experiences in augmented reality (AR) and virtual reality (VR).

Develop interactive games, design educational tours, or craft compelling narratives that blur the lines between reality and digital worlds. The potential for growth in this innovative field is limitless.

I wrote a comprehensive article on how to start a make money online with Virtual reality, check out the link to the article below to learn more.

71. Offer Online Fitness Coaching.

Help people reach their fitness goals and cultivate a healthy lifestyle through personalized online coaching.

Design workout plans, provide nutritional guidance, and offer virtual motivation to clients seeking a remote fitness companion. Platforms like Zoom and Fitbod can facilitate your online training sessions.

I wrote a comprehensive article on how to become a successful online coach, check out the link to the article below to learn more.

- How To Become a Motivational Speaker and Get Paid

- How To Grow Your Coaching Business on Facebook

- How To Make Money Online as a Coach

- How To Do SEO For Your Coaching Business

72. Become a Life Coach or Therapist.

If you have a passion for guiding others towards personal growth and well-being, consider becoming a life coach or therapist who offers online services.

Conduct virtual sessions, provide emotional support, and help clients navigate life’s challenges. Certifications and relevant qualifications are essential for establishing your expertise in this domain.

73. Start a Language Tutoring Business.

Share your fluency and connect with language learners worldwide by starting your own online language tutoring business.

Conduct one-on-one sessions, develop personalized learning plans, and utilize platforms like Italki or Preply to reach a global audience eager to master your language.

74. Offer Online Music Lessons.

Turn your musical passion into a profitable side hustle by providing online music lessons. Whether you play guitar, or piano, or sing like an angel, share your expertise through virtual sessions and help aspiring musicians reach their full potential.

Platforms like Skype and Zoom can bridge the geographical gap and facilitate your musical mentorship.

75. Start a Virtual Bookkeeping Business.

Help businesses stay organized and financially sound by offering virtual bookkeeping services. Master accounting software, manage accounts payable and receivable, and ensure financial accuracy – all from the comfort of your home office.

Platforms like Zirtual and FreeAgent can connect you with clients in need of your financial expertise.

76. Become a Virtual Assistant for Creatives.

Support the creative workflow of busy professionals by becoming a virtual assistant specializing in creative tasks.

Schedule appointments, manage projects, handle social media, and offer administrative support – your organizational skills and creative flair will be invaluable to artists, designers, and other creative minds.

77. Design Custom Websites & Landing Pages.

Help businesses establish a strong online presence by crafting beautiful and functional websites and landing pages.

Master web design tools like WordPress and Adobe Creative Suite, understand user interface (UI) principles and create websites that convert visitors into customers. Freelancing platforms and portfolio websites are your gateways to a thriving design career.

78. Offer Online Interior Design Services.

Guide clients in creating their dream spaces – virtually! Offer online interior design consultations, develop mood boards, recommend furniture and décor, and transform homes without ever stepping foot in them. Platforms like Decorist and Havenly connect design professionals with clients seeking remote design expertise.

79. Start a Freelance Proofreading and Editing Business.

Ensure written content is polished and error-free by offering freelance proofreading and editing services.

Sharpen your eye for detail, master grammar and punctuation, and help writers, businesses, and students refine their written communication. Platforms like ProZ and Upwork are breeding grounds for your meticulous editing skills.

80. Translate Documents & Content.

Bridge language barriers and facilitate international communication by offering translation services.

Choose languages you’re fluent in, specialize in specific domains like legal or medical translations, and connect with clients seeking your linguistic expertise. Platforms like ProZ and Unbabel can open doors to a world of translation opportunities.

81. Offer Online Pet Training & Consulting.

Help pet owners navigate the joys and challenges of pet parenthood through online training and consulting services.

Develop training programs, offer behaviour modification advice, and address common pet issues – all from the comfort of your virtual pet training studio. Platforms like Rover and Wag! can help you reach pet owners in need of your guidance.

82. Develop Educational Games & Apps.

Make learning fun and engaging for children by creating educational games and apps. Combine your tech skills with your passion for education to develop interactive tools that spark curiosity and nurture young minds.

Platforms like Apple App Store and Google Play Store are vast marketplaces for your innovative learning tools.

83. Start a Peer-to-Peer Coaching Community.

Empower individuals on their journey of personal or professional growth by building a vibrant peer-to-peer coaching community online.

Facilitate group coaching sessions, provide accountability structures, and foster a supportive environment for members to learn and grow from each other.

Platforms like Mighty Networks and Circle can provide your community with a dedicated space to connect and thrive.

84. Build a Membership Platform for a Specific Niche.

Cater to a passionate audience by creating a premium membership platform that offers exclusive content, resources, and community.

Choose a niche you’re deeply knowledgeable about, curate valuable content like ebooks, tutorials, or live workshops, and offer members access to a thriving online community.

Platforms like Podia and Kajabi can equip you with the tools to build and manage your paid membership empire.

85. Offer Online Mastermind Groups.

Bring together experts in a specific field to share knowledge, collaborate, and push each other’s boundaries through online mastermind groups.

Facilitate group discussions, host Q&A sessions, and create an environment of mutual learning and support.

Platforms like Mindful and Mastermind.com can connect you with fellow experts eager to participate in high-level peer-to-peer learning.

86. Start a Virtual Coworking Space.

Foster a sense of community and productivity for remote workers by launching a virtual coworking space.

Utilize online tools like video conferencing platforms and coworking software to create a digital workspace where members can connect, collaborate, and stay motivated. Platforms like Remo and Sococo can help you build and manage your virtual coworking haven.

87. Become a Social Media Strategist.

Help businesses leverage the power of social media to build brand awareness, engage audiences, and drive sales.

Master social media platforms like Instagram, Facebook, and TikTok, develop targeted strategies and create engaging content that resonates with their ideal customers.

Platforms like Upwork and Fiverr can connect you with businesses seeking your social media expertise.

88. Offer Public Speaking & Training Services.

Share your knowledge and expertise with a wider audience by offering online public speaking and training services.

Conduct webinars, host workshops, and deliver virtual presentations on topics you’re passionate about.

Platforms like LinkedIn Learning and Udemy can serve as your virtual stage and reach a global audience eager to learn from you.

89. Build a Personal Branding Agency.

Help individuals and businesses craft their online identities and establish themselves as thought leaders in their field.

Offer personal branding consultations, develop social media strategies, and design captivating visual identities that stand out in the digital crowd.

Platforms like Behance and Dribble can showcase your branding expertise and attract potential clients.

90. Become a Business Process Consultant.

Streamline operations and boost efficiency for businesses by offering your expertise in business process consulting.

Analyse workflows, identify areas for improvement, and develop recommendations for optimizing processes and maximizing productivity.

Platforms like Guru and Catalant can connect you with businesses seeking your process optimization skills.

91. Offer Project Management Services.

Guide online projects from conception to completion with your project management expertise. Master project management methodologies like Agile or Waterfall, utilize project management software like Asana or Trello and ensure smooth execution and successful delivery of projects for your clients. Platforms like Project Guru and Freelancer can connect you with project-based opportunities.

Join Us!

Ready to take action and start earning online? Join my free email list for exclusive tips, strategies, and resources to help you make money online.

Sign up now! — https://bit.ly/3wR9rea

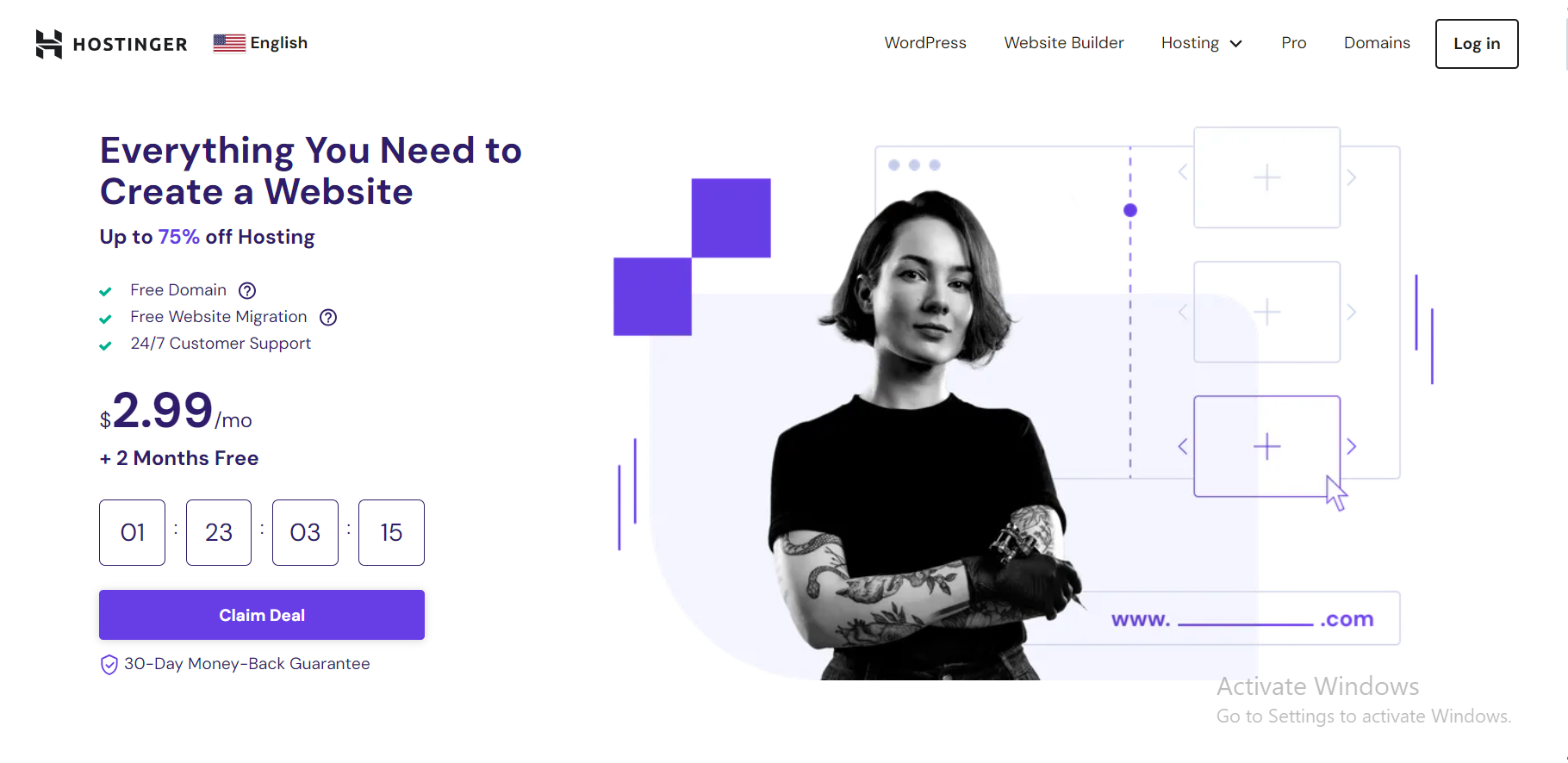

Sponsored

1. Hostinger.

Are you ready to take your online presence to the next level? Hostinger makes it easier than ever to build a stunning website without breaking the bank.

Whether you’re a complete beginner or a seasoned professional, we offer the perfect solution for your needs.

Here’s why Hostinger is the best choice for you:

- Unbeatable Prices: Start with our incredibly affordable shared hosting plans, and scale up as your website grows.

- Powerful Features: Enjoy lightning-fast loading speeds, reliable uptime, and robust security features to keep your website safe and sound.

- User-Friendly Platform: Our intuitive control panel and drag-and-drop website builder make it easy to create and manage your website, even with no coding experience.

- 24/7 Support: Our friendly and knowledgeable customer support team is always available to help you with any questions or issues.

Plus, with Hostinger you get:

- Free domain name: Get your website’s address for free when you sign up for a hosting plan.

- Free SSL certificate: Secure your website and build trust with visitors with a free SSL certificate.

- Email accounts: Create professional email addresses for your business with your hosting plan.

- 1-click WordPress installation: Get your WordPress website up and running in seconds with our easy installation tool.

Ready to get started? Choose the plan that best suits your needs and launch your dream website today!

TRY IT NOW – Hostinger.com

Conclusion.

Starting an online business can offer many benefits, including flexibility, lower start-up costs, access to a global market, reduced overhead costs, opportunities for innovation, and increased revenue potential.

Of course, starting any business requires hard work, dedication, and a solid business plan, but if you’re ready to leap, an online business could be the perfect choice for you.

Remember, this is just a taste of the endless possibilities waiting for you in the online world. With dedication, passion, and the right skills, you can turn your side hustle into a thriving online business and unlock financial freedom on your terms.

Start exploring the options that resonate with you, build your online presence, and watch your entrepreneurial spirit take flight this year

This guide is just a starting point, and each side hustle requires further research and preparation before you launch.

Remember to understand the legal and tax implications of operating an online business in your region, and build a strong brand and marketing strategy to reach your target audience.

While starting an online business may not be the right choice for everyone, it is certainly worth considering for anyone who is looking for a more flexible and rewarding career path.

Join Us!

Ready to take action and start earning online? Join my free email list for exclusive tips, strategies, and resources to help you make money online.

Sign up now! — https://bit.ly/3wR9rea

![50+ Most Profitable Online Businesses To Start In 2024 [UPDATED] Most Profitable Online Businesses](https://tchelete.com/wp-content/uploads/2022/06/photo-1553484771-0a615f264d58-758x506.jpg)

GIPHY App Key not set. Please check settings