Introduction.

Managing international payroll can be a daunting task for businesses of all sizes. With various tax laws, regulations, and currency fluctuations, it can be challenging to ensure that employees are paid accurately and on time.

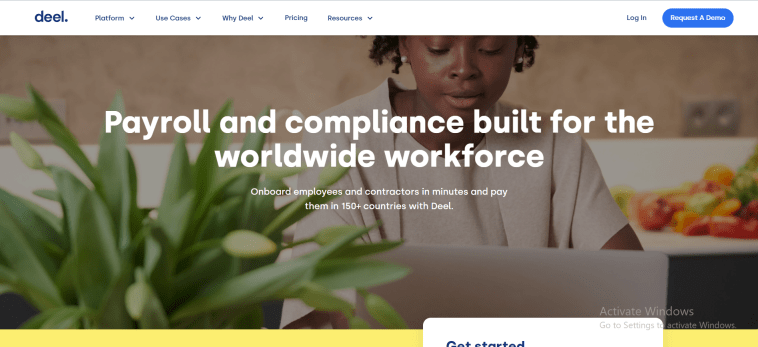

That’s where Deel comes in – a comprehensive international payroll platform designed to simplify the entire payroll process.

Deel offers a full suite of services for managing global payroll, including tax compliance, benefits administration, and HR support.

With its easy-to-use platform, businesses can quickly onboard international employees, set up payroll in multiple currencies, and ensure compliance with local tax laws.

In this article, we’ll take a closer look at how Deel can help you organize your international payroll, streamline your operations, and ensure that your employees are paid accurately and on time.

Whether you’re a small business just starting to expand internationally or a large enterprise with a global workforce, Deel can help simplify your payroll process and save you time and money.

What is Deel?

Deel is a comprehensive platform designed to simplify the process of managing international payroll and compliance for businesses of all sizes.

It offers a full suite of services, including onboarding, payroll management, tax compliance, and HR support.

Deel’s platform is designed to make it easy for businesses to manage their global workforce, regardless of location or currency.

It offers features such as automated payments, multiple currency support, and compliance with local tax laws. Additionally, it provides access to local experts who can provide guidance on local regulations and help businesses stay compliant.

Deel is a cloud-based platform, meaning that it can be accessed from anywhere with an internet connection.

This makes it easy for businesses to manage their payroll and compliance from anywhere in the world.

It is trusted by thousands of businesses worldwide, including some of the world’s leading remote-first companies.

Why Do I Need a Deel Account?

In today’s globalized world, more and more businesses are operating across borders. While this presents many opportunities for growth and expansion, it also creates challenges when it comes to managing payroll and compliance.

This is where Deel comes in – a platform that simplifies the process of managing international payroll and compliance. Here are some reasons why you might need a Deel account:

1. Simplify your international payroll.

Managing payroll across borders can be a complex and time-consuming process. With Deel, businesses can easily manage their international payroll, including setting up payments in multiple currencies, ensuring compliance with local tax laws, and automating payments to save time.

2. Ensure compliance with local regulations.

Each country has its own set of tax laws and regulations. Deel can help ensure that your business stays compliant with local regulations by providing access to local experts who can provide guidance on local regulations and help businesses stay compliant.

3. Streamline your onboarding process.

Onboarding international employees can be a complex process. With Deel, businesses can easily onboard new employees, including setting up payroll, providing access to benefits, and ensuring compliance with local regulations.

4. Access to local support.

Deel provides businesses with access to local experts who can provide guidance on local regulations and help businesses stay compliant.

This can be especially helpful for businesses that are new to operating in a particular country or region.

5. Save time and money.

By automating payroll and compliance processes, businesses can save time and money that can be invested in other areas of the business.

Additionally, Deel’s platform is designed to be user-friendly, making it easy for businesses to manage their international payroll and compliance without needing to hire additional staff.

6. Manage benefits and contracts.

In addition to managing payroll, Deel also offers businesses the ability to manage benefits and contracts for their international employees.

This can include things like health insurance, retirement plans, and employment contracts.

By managing these aspects of employment through Deel, businesses can ensure that their employees receive the same level of support regardless of where they are located.

7. Reduce risk.

Managing international payroll and compliance can be risky if not done correctly. By using a platform like Deel, businesses can reduce the risk of errors or non-compliance, which can result in costly fines or legal issues.

8. Scale your business.

As businesses grow and expand, managing international payroll and compliance can become even more complex.

Deel’s platform is designed to scale with businesses, providing the same level of support whether you have a handful of international employees or a large global workforce.

9. Access to reporting and analytics.

Deel’s platform provides businesses with access to reporting and analytics tools that can help them better understand their global workforce.

This can include things like employee turnover rates, payroll expenses, and benefits utilization. By having access to this information, businesses can make more informed decisions about their global operations.

10. Stay competitive.

In today’s global business environment, staying competitive means being able to operate across borders.

By using a platform like Deel, businesses can manage their international payroll and compliance more efficiently, allowing them to focus on other aspects of their business and stay competitive in their industry.

How do I Organize My International Payroll With Deel?

Managing international payroll can be a complex and time-consuming process, especially for businesses that operate across multiple countries.

Fortunately, platforms like Deel make it easier than ever to manage international payroll and compliance. Here’s how to organize your international payroll with Deel:

1. Sign up for a Deel account.

The first step in organizing your international payroll with Deel is to sign up for an account. Deel’s platform is designed to be user-friendly, so the sign-up process should only take a few minutes.

2. Set up your account.

Once you’ve signed up for an account, you’ll need to set up your account by entering your company information, including your business name, address, and tax ID. You’ll also need to set up your payment methods, including the currencies you want to pay in.

3. Add your international employees.

Next, you’ll need to add your international employees to the platform. This can be done by entering their basic information, including their name, email address, and country of residence.

4. Set up payroll.

Once you’ve added your employees, you’ll need to set up payroll. Deel’s platform makes it easy to set up payments in multiple currencies and ensures compliance with local tax laws.

5. Manage benefits and contracts.

In addition to managing payroll, Deel also offers businesses the ability to manage benefits and contracts for their international employees. This can include things like health insurance, retirement plans, and employment contracts.

6. Ensure compliance with local regulations.

Each country has its own set of tax laws and regulations. Deel can help ensure that your business stays compliant with local regulations by providing access to local experts who can provide guidance on local regulations and help businesses stay compliant.

7. Automate payments.

One of the benefits of using a platform like Deel is the ability to automate payments. This can save businesses time and ensure that payments are made on time and in the correct currency.

8. Access to reporting and analytics.

Deel’s platform provides businesses with access to reporting and analytics tools that can help them better understand their global workforce. This can include things like employee turnover rates, payroll expenses, and benefits utilization.

9. Communicate with your international team.

Deel’s platform also includes a messaging system that allows businesses to communicate with their international team members.

This can help answer questions, provide support, and stay in touch with team members who may be located in different time zones.

10. Access to local experts.

One of the benefits of using Deel is access to local experts who can provide guidance on local regulations and help businesses stay compliant.

Deel’s platform includes a team of local experts who can provide support and guidance on tax laws, employment regulations, and other aspects of managing a global workforce.

11. Streamline processes.

By using a platform like Deel, businesses can streamline their international payroll processes, saving time and reducing the risk of errors.

With its user-friendly interface and automation tools, Deel makes it easy to manage international payroll and compliance.

12. Focus on your business.

Managing international payroll can be a time-consuming process. By using a platform like Deel, businesses can focus on other aspects of their business, such as growing their customer base, developing new products, or expanding into new markets.

13. Scalability.

Deel’s platform is designed to be scalable, which means that it can accommodate businesses of all sizes, from small startups to large multinational corporations.

This scalability means that businesses can grow and expand their operations without having to worry about managing their international payroll processes.

14. Data security.

When managing international payroll, data security is a top priority. Deel’s platform is designed with data security in mind, using the latest encryption and security protocols to ensure that your data is protected at all times.

15. Transparent pricing.

Deel’s pricing is transparent and easy to understand, with no hidden fees or charges. Businesses can choose from a variety of pricing plans based on their needs and budget, with the option to upgrade or downgrade their plan as their business grows and evolves.

Conclusion.

There are many reasons why a business might need a Deel account. Whether you’re looking to simplify your international payroll, ensure compliance with local regulations, or manage benefits and contracts for your international employees, Deel’s platform can help.

With its comprehensive suite of services, user-friendly platform, and access to local experts, Deel is a valuable tool for businesses of all sizes looking to manage their global workforce.

Finally, organizing your international payroll with Deel can provide businesses with numerous benefits, including scalability, data security, transparent pricing, and streamlined processes.

By using Deel’s platform, businesses can focus on growing their business and expanding their operations, while leaving the complex task of managing international payroll to the experts.

Now is the best time to get on board with Deel, having to manage an international team does not have to be hard. Check out the link to get started.

TRY IT NOW – Deel.com

GIPHY App Key not set. Please check settings