Introduction.

In today’s fast-paced world, managing personal finances effectively is crucial for individuals seeking financial stability and growth.

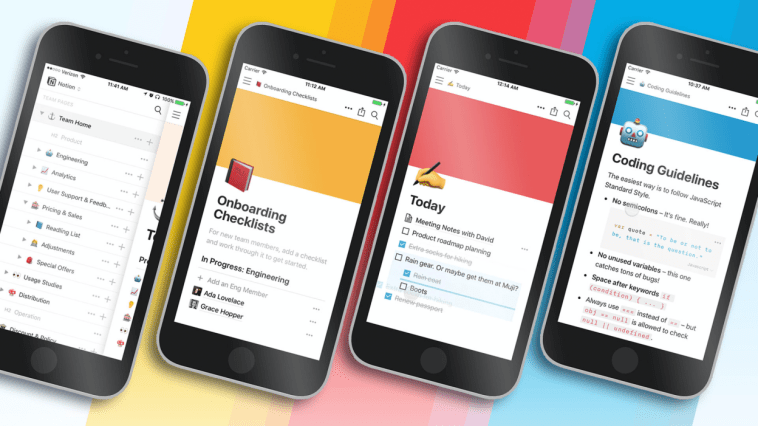

One powerful tool that has gained popularity in recent years is Notion, a versatile productivity application that allows users to create customizable databases, task lists, and more.

With its user-friendly interface and extensive customization options, Notion provides an excellent platform for building a personalized finance tracker.

By developing a finance tracker in Notion, you can gain a comprehensive overview of your income, expenses, budgets, and financial goals, all in one central location.

This empowers you to make informed decisions about your spending habits, track your progress towards financial milestones, and ultimately take control of your financial well-being.

In this guide, we will explore the step-by-step process of building a finance tracker in Notion.

We’ll cover the essential elements you need to include, such as income tracking, expense categorization, budgeting, and visual representations of your financial data.

Additionally, we’ll discuss how to leverage Notion’s flexible features to tailor your finance tracker to your specific needs and preferences.

Whether you’re a seasoned budgeting pro or just starting your financial journey, creating a finance tracker in Notion can be a valuable tool to help you achieve your financial goals.

Hey there, dear reader! We hope you’re enjoying the content on our blog. Did you know we have a treasure trove of other insightful articles waiting for you?

Checkout the links to the article below to become more productive and scale your Notion experience.

- How To Make Money Selling Notion Templates

- How To Make Money Online With Notion

- How To Make Money With Notion Templates

- How To Become a Notion Consultant

- How To Personalize Notion

- How To Use Notion For Social Media Management

- How To Sell Notion Templates On Etsy

- How To Build a Website On Notion

- How To Build Your Portfolio On Notion

- How To Use Notion For Personal Use

- How To Use Notion For Research

So, let’s dive in and discover how you can leverage the power of Notion to build a comprehensive and personalized finance tracker that empowers you to take control of your finances.

How Do I Build a Finance Tracker In Notion?

Notion is a versatile productivity application that allows you to create customized databases, task lists, and more.

By leveraging Notion’s features, you can build a comprehensive finance tracker tailored to your specific needs. In this article, we will guide you through the step-by-step process of building a finance tracker in Notion.

Step 1: Define Your Financial Goals and Metrics.

Before diving into building your finance tracker, it’s important to define your financial goals and the metrics you want to track. Consider what aspects of your finances are most important to you.

Do you want to track your monthly expenses, monitor your savings progress, or analyze your investment portfolio?

By identifying your financial objectives, you can design your finance tracker to focus on these areas and provide you with the information you need.

Step 2: Set Up Your Notion Workspace.

To get started, create a new workspace in Notion dedicated to your finance tracker. This will serve as a central hub where you can store all your financial data and tracking tools.

Within the workspace, you can create separate pages or sections for different aspects of your finances, such as income, expenses, budgets, and financial goals.

Step 3: Create Income Tracking.

One of the fundamental components of a finance tracker is tracking your income. Create a database in Notion to record your income sources, including salary, freelance work, or passive income.

Include columns for the date, income source, amount, and any additional details you want to track. You can also create formulas to calculate your total income for a specific period or analyze your income trends over time.

Step 4: Track Your Expenses.

Next, create a database to track your expenses. Categorize your expenses into different categories such as groceries, bills, transportation, and entertainment.

Include columns for the date, expense category, amount, payment method, and any relevant notes. Notion allows you to add tags to your expenses, making it easier to filter and analyze your spending habits.

Step 5: Budgeting and Expense Analysis.

To maintain financial discipline, it’s crucial to set up a budget and track your expenses against it. Create a separate database or page to set your budget for various expense categories.

Include columns for the category, budgeted amount, and actual spending.

You can use formulas in Notion to calculate the variance between your budgeted amount and actual spending, providing insights into areas where you may be overspending or underspending.

Step 6: Visualize Your Financial Data.

Visual representations of your financial data can provide a clearer understanding of your financial situation. Notion offers various visualization options, such as charts and graphs.

You can create visualizations to display your income and expense trends, budget progress, or investment portfolio performance.

These visuals can help you identify patterns, make informed decisions, and stay motivated towards achieving your financial goals.

Step 7: Automate Data Entry and Updates.

To streamline the process of updating your finance tracker, consider automating data entry. Notion supports integrations with other apps and services, allowing you to import transactions automatically from your bank accounts or expense-tracking apps.

This automation can save you time and ensure that your finance tracker remains up-to-date without manual data entry.

Step 8: Customize and Iterate.

Notion’s flexibility allows you to customize your finance tracker to align with your unique preferences and requirements.

Experiment with different layouts, templates, and additional fields to capture specific information relevant to your finances.

Regularly review and iterate on your finance tracker as your financial situation evolves or your tracking needs change.

Conclusion.

Building a finance tracker in Notion can provide you with a powerful tool for managing your finances effectively.

By following the step-by-step process outlined in this article, you can create a comprehensive and personalized finance tracker tailored to your financial goals and metrics.

Notion’s versatility and customization options empower you to track your income, expenses, budgets, and financial goals all in one central location.

Hey there, dear reader! We hope you’re enjoying the content on our blog. Did you know we have a treasure trove of other insightful articles waiting for you?

Checkout the links to the article below to become more productive and scale your Notion experience.

- How To Make Money Selling Notion Templates

- How To Make Money Online With Notion

- How To Make Money With Notion Templates

- How To Become a Notion Consultant

- How To Personalize Notion

- How To Use Notion For Social Media Management

- How To Sell Notion Templates On Etsy

- How To Build a Website On Notion

- How To Build Your Portfolio On Notion

- How To Use Notion For Personal Use

- How To Use Notion For Research

Take control of your financial well-being by harnessing the power of Notion to build a finance tracker that keeps you organized, informed, and on track to achieve your financial aspirations.

GIPHY App Key not set. Please check settings